Andrew Bailey, chief executive of the Financial Conduct Authority (FCA), remains unconvinced the recommendations laid out in the Financial Advice Market Review (FAMR) will close the advice gap.

Speaking at a Treasury committee hearing on Wednesday (20 July), Bailey said the Retail Distribution Review had tackled opaque commission and adviser qualifications but had contributed to the advice gap which FAMR aimed to close.

However, he said: "I think they [the FAMR recommendations] have the potential to work but we cannot sign it off with conviction.

"A lot of it rests on whether we get useful technology that can be put to work. The jury is out on that one. Not because fintech is bad but can it do the iterative work the advice process needs?"

FAMR, released in March this year, outlined steps the industry could take to close the advice gap, which has seen people with moderate assets priced out of financial advice and those who need ad hoc assistance on financial decisions with nowhere to go.

It set out a series of policy recommendations including changes to the definition of regulated financial advice, the introduction of a pensions dashboard for consumers and a exploration of a risk-based levy for the Financial Services Compensation Scheme.

It also said the development of technology in the advice process, including greater access to robe-advice would help address the advice gap.

The FCA itself launched a robo-advice unit to help advisers bring services to market in June.

Headhunted

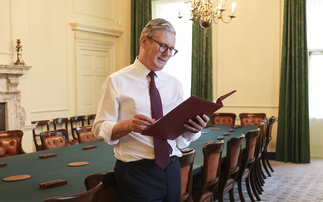

Elsewhere in the evidence session, Bailey admitted he was not looking for another job when he was approached by the Chancellor to take over at the FCA.

When challenged over the fact he had not applied or been through the usual rigorous interview process he said he loved working at the Prudential Regulation Authority (PRA) and only considered the FCA top job when Tracey McDermott pulled out of the running.

His appointment has previously been described by members of the Treasury committee as "extraordinary".

"I was not looking for another job. I hugely enjoyed working at the PRA. I loved it. It was a great job. I did not want to compete with Tracey but she pulled out in mid-December. I was contacted and asked to see the Chancellor.

"I spent two weeks thinking about it. It was a hard decision as I loved the place that I worked in. I loved setting up the PRA. The Chancellor did put back to me some of my own words, I have said for twin peaks regulation to work both peaks have to be ‘firing' as it were.

"I mentally asked myself: are you up for a challenge? I was."