Ash Borland, business coach, Ash Borland Consulting, discusses why it is vital for mortgage advisers to have the protection conversation.

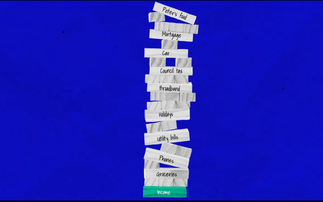

Most mortgage advisers don't avoid protection because clients resist it. They avoid it because they do. It's rarely said out loud, but it shows up every day in how advice is delivered. Protection is softened, delayed, rushed or quietly parked at the end of the process. Not because the client objected, but because the adviser decided, in advance, that the conversation might feel uncomfortable. The justification usually sounds reasonable: "I don't want to force it." "I don't want to sound salesy." "I don't want to risk the relationship." But avoidance doesn't protect the relations...

To continue reading this article...

Join COVER for free

- Unlimited access to real-time news, key trend analysis and industry insights.

- Stay on top of the latest developments around health and wellbeing, diversity and inclusion and the cost of living crisis.

- Receive breaking news stories straight to your inbox in the daily newsletter.

- Members only access to monthly programme 'The COVER Review'

- Be the first to hear about our CPD accredited events and awards programmes.